- ATV accidents

- Brain Injuries

- Bus Accident

- Car Accidents

- Construction Accident

- Distracted Driving

- Drugged Driving Accident

- DUI

- Firm News

- Mass Tort

- Medical Malpractice

- Motorcycle Accidents

- Pedestrian Accidents

- Personal Injury

- Product Liability

- Safety

- Social Security Disability

- Truck Accidents

- Vehicle Accidents

- Workers Compensation

- Workplace Injuries

Ridehail apps like Uber and Lyft continue to experience a growth trend. In 2019, Uber averaged 111 million users per month, and provided a whopping 6.9 billion rides.(1) These ridehail companies provide consumers with a taxi-like service, but at a reduced cost. In smaller cities where taxis aren’t in common use, ridehailing (sometimes called ridesharing or ridebooking) can also be more convenient and time effective. And given that ridehail companies offer drivers the flexibility to choose their own hours, it’s easy to see why becoming a ridehail driver is popular with those seeking to earn extra money. Barring unforeseen changes, it looks as if the ridehail industry is here to stay.

As the number of ridehails increase, so will accidents. What happens if you’re injured as a passenger while in an Uber or a Lyft? How does the process work if your auto is involved in an accident with a ridehail vehicle? Liability in these instances is not as straightforward as the typical accident between two personal-use autos.

Which Coverage Applies?

Most personal auto insurance policies in Kentucky exclude commercial activity, such as driving for Uber or Lyft. Ridehail drivers are considered independent contractors, not employees. Both Uber and Lyft offer accident coverage to drivers, but these Rideshare Policies have limitations as to when the coverage is in force. For example, Uber’s insurance coverage only kicks in if/when the driver’s personal auto insurance has been exhausted. Then timing of the accident becomes important as it determines level of coverage.

Uber’s Coverage Depends upon Driver’s Activity at Time of Accident

1. When a driver is logged into the Uber app as “available” and awaiting a ride request, the following coverage applies: $50,000 per person bodily injury; $100,000 per accident bodily injury; $25,000 per accident property damage.

2. When a driver is en route to pick up riders and/or during a trip, the following coverage applies: $1,000,000 third-party liability; uninsured/underinsured motorist bodily injury according to state level; contingent comprehensive and collision up to the cash value of car (minus $1,000 deductible) that is applicable if driver’s personal policy has full comprehensive.(2)

Did the Driver Opt-out of No-Fault Coverage?

Kentucky is one of around a dozen states that has “no-fault auto insurance.” In a no-fault state, the driver turns to their own auto insurance company for compensation to cover medical bills, etc., regardless of who was at fault in causing the accident. However, Kentucky drivers may choose to opt-out of the no-fault system. If you’re injured as a ridehail passenger, you’ll need to understand whether the driver’s or the passenger’s personal injury protection (PIP) coverage will apply to your situation.

What to Do If You’ve Been in an Accident

If you’ve been involved in an accident with a vehicle operating under a ridehail company, it’s important to seek the legal advice of an attorney who is experienced in auto personal injury claims. Accidents involving Uber, Lyft or a similar ridehail service, will always be more complicated. Before you speak with an insurance company about your injuries, give us a call. We will help you navigate the process and preserve your legal rights.

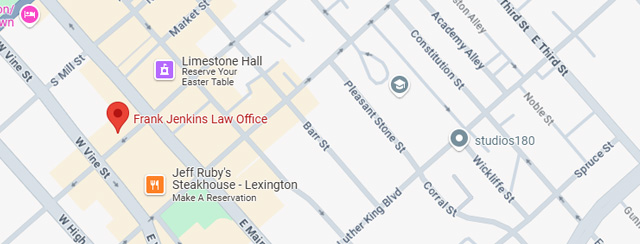

Frank Jenkins Law Office

(859) 389-9344

References:

1.) Mazareanu, E. (2020, May 29). Uber’s users of ride-sharing services worldwide 2017-2020. Retrieved from https://www.statista.com/statistics/833743/us-users-ride-sharing-services/

2). Auto Insurance to Help Protect You. (n.d.). Retrieved July 1, 2020, from https://www.uber.com/us/en/drive/insurance/